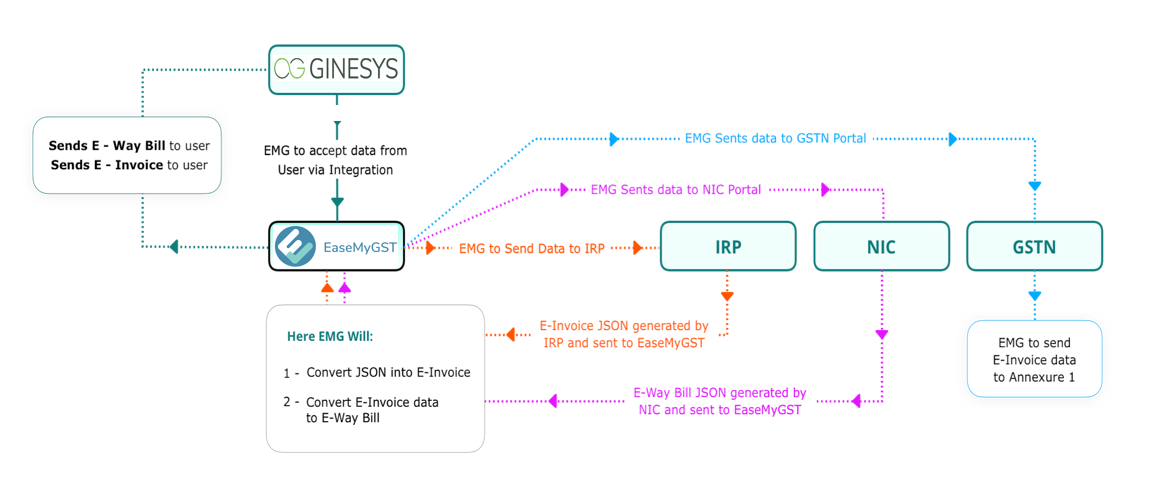

e-Invoicing requires submitting an already generated standard invoice on a government E-invoicing portal. Thus, it reports to the tax authorities the details of the invoice instantly and leads to its authenticity and comparison with the purchase invoices submitted or other data.

Under the electronic invoicing system, an identification number will be issued against every invoice by the Invoice Registration Portal (IRP) - called IRN , managed by the GST Network (GSTN).

- Single or Multiple-Source data input is supported

- Aggregate & Segregate data from each Dept/BU

- Convert/Flip Order data to FA (1) e-invoice

- Validate e-Invoice data

- Enriched APIs to handle data encryption and decryption

- eInvoice and e-Way bill generation in single upload

- Multiple NIC APIs bundled to single API

- Immediate update to source system of success/failure notifications from IRP

- Determine tax rate

- Converting signed JSON to graphical QR

- e-Delivery of Invoices

.png)